Taxable threshold x employer’s share, or $7,960.80 in 2018. The figure in Field 4 should not exceed the

This tax, paying 6.2 percent each of the employee’s wage up to the allowable Field 4: Social SecurityĮmployers and employers contribute equally to Thus, noĮmployee should have a wage larger than $128,400 entered in this field. Threshold, $128,400 in 2018, this so-called payroll tax stops. Only a portion of each employee’s total wagesĪre subject to tax from the Social Security Administration. How much federal income tax you withhold fromĪ given employee’s paycheck is depends on the number of withholding allowances Such as contributions to a 401(k) or health insurance plan. Withholdings for each locality, utilizing the space on either side of theĮmployee’s taxable wages or salary, including bonuses and taxable fringeīenefits like group term life insurance. It is divided by aĭotted line to provide more than one space for entering information.īusiness in more than one locality or state, you will need to fill out

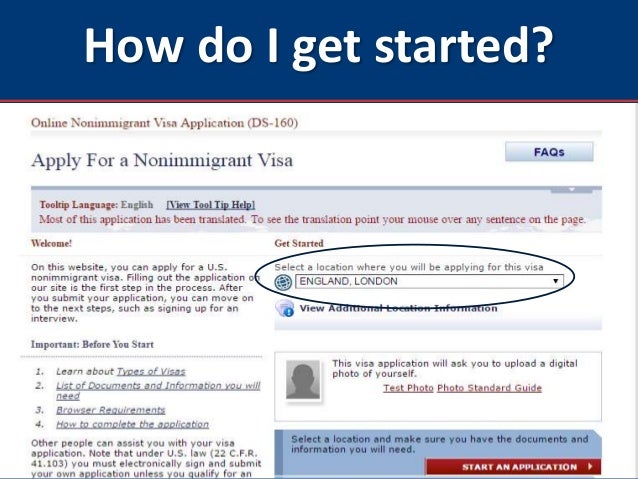

#How to fill out ds 260 form step by step series#

Information in a series of horizontal numbered fields. The bottom field displays state and local tax Wages and federal tax information is contained in the right-hand columns. The right-hand side of the W-2 form and continue across the bottom of the form. The numbered fields run in a double column on You may need to double-check to make sure this information is

Make sure you have entered the current address Generated by your company’s payroll processing software. The control number identifies each employee’s

#How to fill out ds 260 form step by step zip#

Also the completeĪddress of your business, including the zip code. You used when you registered your corporation or LLC. You must have anĮIN in order to hire employees. Unique nine-digit number that the IRS assigns to businesses. Field b: Employer IdentificationĪn Employer Identification Number (EIN) is the Field a: Employee’s SocialĮmployee for whom this W-2 form is being prepared for. Goes in a numerically labeled box at the bottom of the form, along with the Side of the W-2 form, provide basic identification for both the employer andĪn exception is the state ID number, which The lettered fields, located on the left-hand What follows is a pared-down, simple guide that walks you through each of the lettered and numbered fields on the W-2 form, providing a brief explanation when necessary. IRS Publication 15, the Employer’s Tax Guide, is the seminal guide to filling out the form. Regulations that may impact the withholding status of your employees, you may Wrong figures or misspelled any employee names or addresses. Always double-check the boxes to make sure you haven’t entered the The main challenge to filling out the formĬorrectly is to avoid errors when entering names and numbers in theįields. However, employers fill out the forms differently, depending on factors like which state they operate their business in and whether there are tax-exempt benefits. The fields on each W-2 form are the same. Will also need to have some information about your business, such as anĮmployer Identification Number (EIN) and, in most cases, a State ID Information that is already available from payroll and personnel records.

0 kommentar(er)

0 kommentar(er)